Get to Know the Faces Behind Our Success!

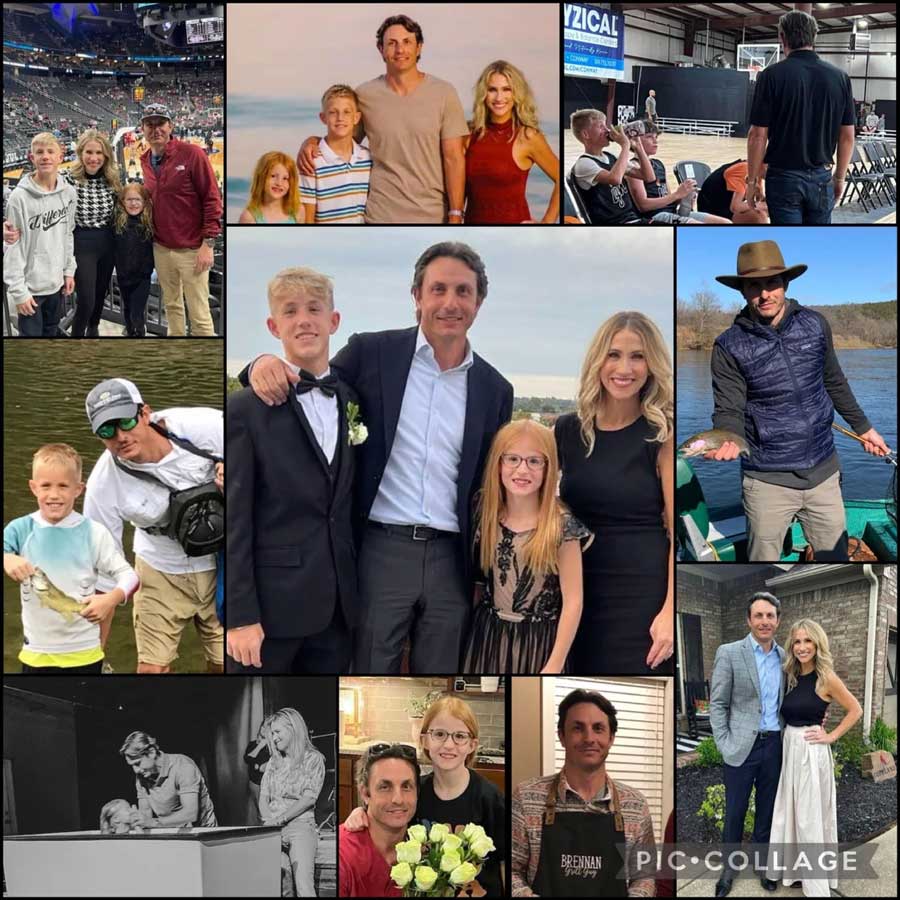

Brennan McCutchen

Managing Partner

Brennan McCutchen, AIF®, serves as Managing Partner for the Little Rock Office. He is also a member of the firm’s Investment Advisory Committee, and holds FINRA series 7, 63, and 65 securities registrations, and is an Accredited Investment Fiduciary (AIF®) Designee.

Brennan has more than 20 years of equity markets experience focusing exclusively on financial planning and investing for retirement. Further, Brennan works with companies and their trustees/committees to design and implement retirement plans that focus on participants. Financial wellness education and high-level fiduciary investment consulting ensure that employers are providing innovative and practical solutions that drive real results for their employees.

Brennan graduated from the University of Central Arkansas (B.B.S. Finance). After graduation, he served as senior Stockbroker at Scottrade, Inc. In 2006, Brennan joined Hagan Newkirk Financial as an investment advisor and was one of three partners to purchase Hagan Newkirk and transition the company to Prime Capital.

By day, Brennan navigates the financial world. But on the weekends, you can find him coaching his children’s sports teams, fishing his favorite honey holes, or honing his skills on the golf course (and pretending to count all of those as exercise). Together with his wife Shelly, they are deeply engaged in their local church, as well as Downline Ministries. Brennan’s greatest source of joy comes from creating memories and traveling with Shelly and their two children.

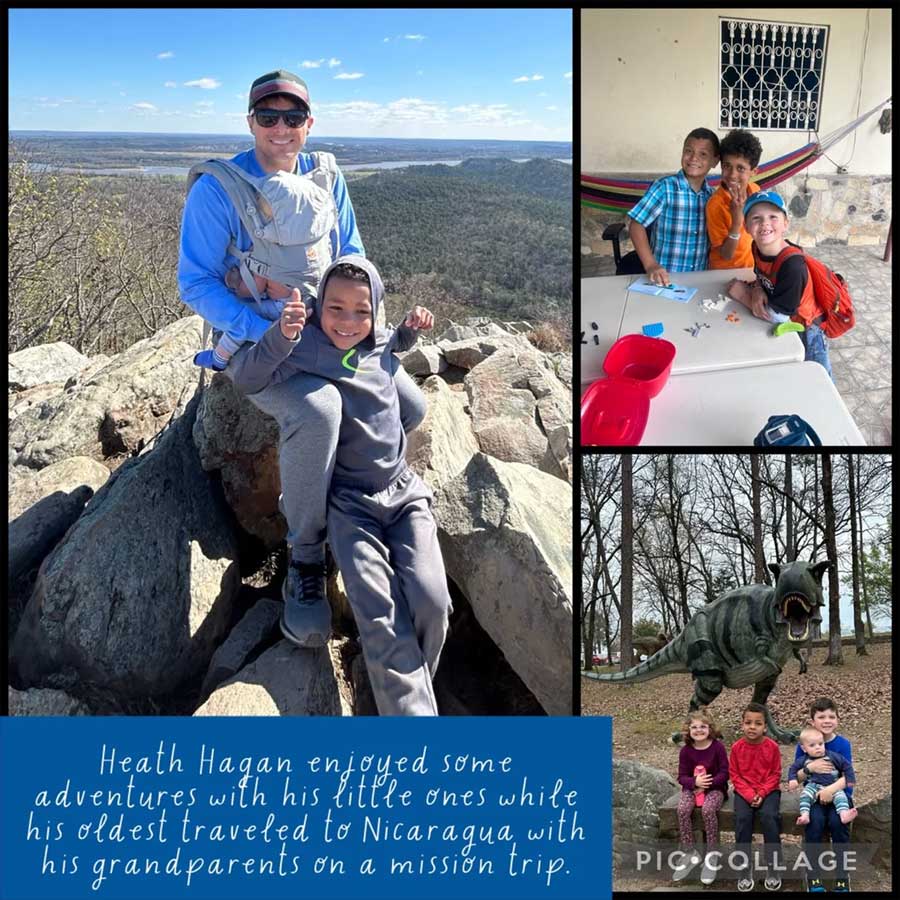

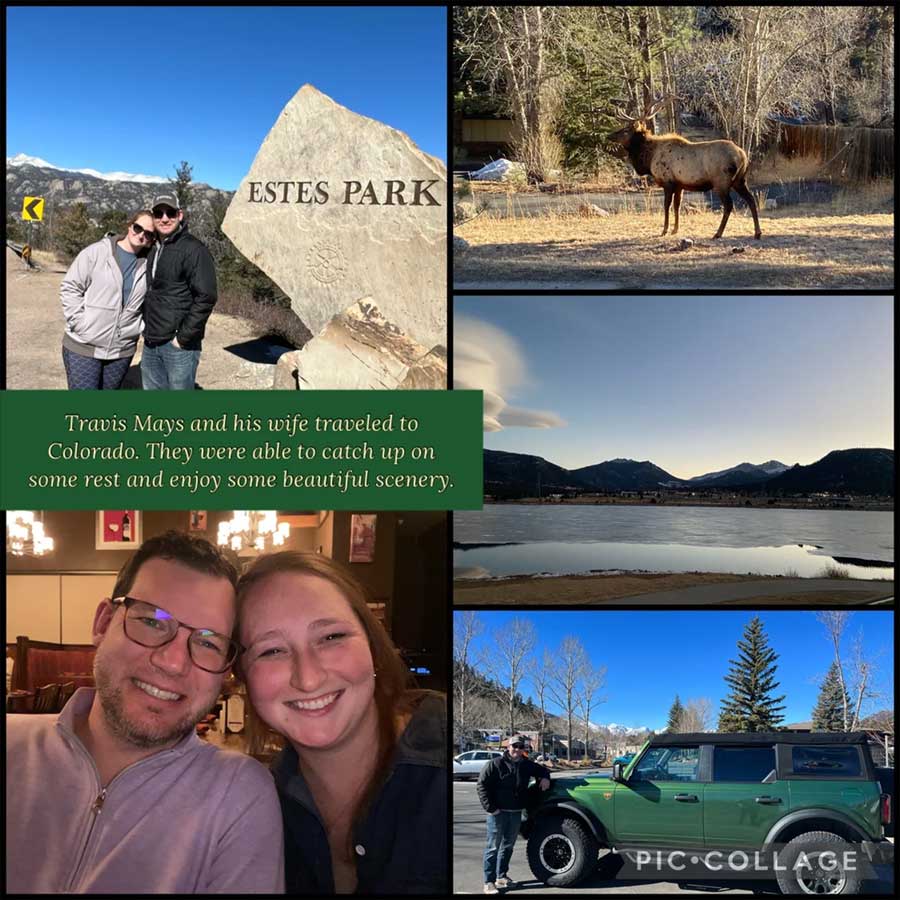

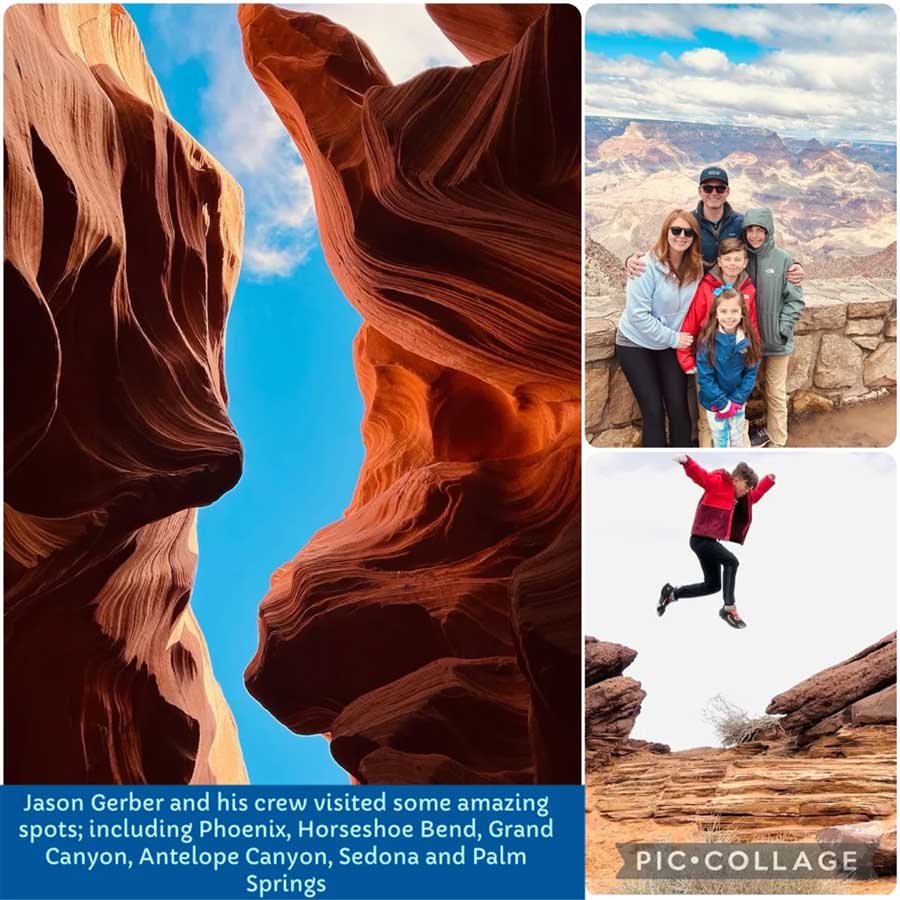

Embracing Spring Break

This past week, most of us were able to enjoy a little hiatus from the office. There are a couple times a year that allow us to spend some extra quality time with our families, making memories. Prime Capital believes in the importance of the work-life balance and encourages it. Spring break is usually one of those opportunities and we are thankful for the chance to hit the pause button and recharge the batteries. We are better for it. Enjoy these highlights!

Delicious Carrot Cake

This carrot cake is so moist and luxurious! It’s the perfect dessert for your Sunday lunch or dinner. You can find the recipe here. Enjoy!

Industry Insights and Education

We’ve heard it before. Annuities within workplace retirement plans are poised for explosive growth. This is due in large part to doors being opened by friendly provisions within the SECURE Act and SECURE 2.0 and ramped-up demand from a wave of “Peak 65” 401(k) participants looking to turn a part of their account balance into a guaranteed stream of lifetime income.

But the long road to winning over plan sponsors and participants has been an uphill one filled with hazards that have kept most players on the sidelines to date.

With a lot of hard work and lessons learned, components for a successful annuities-within-401(k)s game plan now appear to be in place. Will 2024 finally be the year in-plan annuities turn the corner and win over the workplace retirement plan market?

“We are portable on two national recordkeepers and will be live on two more, adding two of the largest recordkeepers in the country,” said Scott Colangelo, chairman and managing partner of Prime Capital Investment Advisors.

For the full story check it out here.

P.S. Check out our latest comments in prominent industry publications!

- “Some of these different market cycles demonstrate the need that people have for someone to help them make decisions about their money,” our own Jason Gerber told PLANADVISER about the rising demand for holistic planning. View article here!

- Managing Partner of Little Rock, Jason Gerber was featured in Kiplinger! If you are interested in learning more about six of the best budgeting apps, click here to view the article!

- In case you missed it! National Retirement Practice Leader Matthew Eickman was recently featured in Rachel Hartman’s U.S. News & World Report article: Biden’s Crackdown on Junk Fees in Retirement Plans.

Mark Your Calendar – May 6-7, 2024

Innovative strategies that can help make your organization’s retirement program more competitive? Yeah, we’ve got that. This event is truly unique. Most of the retirement plan industry conferences target a narrow category of individuals. Not this one.

With the Qualified Plan Fiduciary Summit, we’ve recognized that we’re all better when we have the opportunity for employers, advisors, recordkeepers, wellness providers, and investment professionals to learn from each other. This is not a “plan sponsor event” or an “advisor event”. This is a unique event for people who are passionate about the responsibilities and opportunities presented by our work with retirement plans, and the commitment to being the best at what we do.

P.S. Catch us in our natural habitat! Some of our team members went to The New York Stock Exchange this month. As Travis put it, “It truly was a bucket list trip for me.”

For a yearly review, give us a call today!

This article is not to be construed as financial advice. It is provided for informational purposes only and it should not be relied upon. It is recommended that you check with your financial advisor, tax professional and legal professionals when making any investment or any change to your retirement plan. Your investments, insurance and savings vehicles should match your risk tolerance and be suitable as well as what’s best for your personal financial situation.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite 150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Certain services may be provided by affiliates of PCIA.